By Tiana Lowe, Commentary Writer | Washington Examiner

Consumer prices rose by 8.5% annually, according to March CPI numbers just released by the Bureau of Labor Statistics. That inflation rate, the highest in 41 years, comes thanks to staggering food prices, which rose by a full percentage point in just the past month, and gas prices, up nearly 50% over the past year.

The Fed, like other Western central banks, claims to aim for a 2% benchmark

for inflation. Despite inflation consistently rising over the past year to

the highest point in four decades, the Fed waited until just last month to

impose its first rate hike in four years, and even then used Vladimir

Putin's invasion of Ukraine to choose a measly 25 basis points rate hike despite

knowing full well that it was not enough to stanch soaring prices.

So consider this: In the past two months alone, the consumer price index has

risen by 2%, or the entirety of what central bankers claim to tolerate over the

course of a full 12 months.

The pajama class will smugly retort that central bankers actually only care

about core CPI, that is, the index without those volatile categories of food

and energy. But as inflation has come to cost the average person $100 a week,

the increasingly regressive nature of the catastrophe ought to take precedence

over "full employment," The Current Thing of the Week, or whatever

pet project overpaid financiers in Faconnable care about today.

In the past month alone, the price of food at home, the sort relied on by

workers unable to afford dining out, increased by 1.5%. Fuel increased by

22.3% and rent by another 0.4%.

Inflation always disproportionately affects the poor, even when core CPI

outpaces CPI. Wealthier folks can always downgrade from Whole Foods to Trader

Joe's, cancel that expensive vacation, take worn shoes to the cobbler, and

postpone date nights downtown. But at a certain point, poor people already

penny-pinching are stuck.

Unless you can listen to the Biden administration and simply shell out the

average $63,000 for an electric car — that is $15,000 higher than the overall

industry average — the commute to work will never magically require less gas. A

family already splitting bedrooms and bathrooms will never magically fit in a

smaller apartment, and growing children will never magically need fewer

calories. So, if you're already living paycheck to paycheck, a nearly 14%

increase in meat and poultry prices over the past year means the only way

the children get fed is if the least healthy options in the grocery store are

chosen or if the parents have to start skipping meals. If the finance class

still smugly wants to defend the Fed's obsession with core CPI, this is the

logical conclusion: that the people who need price stability the most are those

forgotten by the world's most powerful central bank.

https://www.washingtonexaminer.com/opinion/we-just-got-a-years-worth-of-inflation-in-two-months

RELATED

ARTICLE

Bidenflation Roars On, Setting New Record

Highs

By Kevin Jackson

It hasn't been this bad since 1981.

I remember spending weekends with my great-grandmother

as an adolescent. She always made us the best breakfasts. And she had a giant

lightbulb “chandelier” hanging over the small table in the kitchen nook. My

sisters and I often giggled at her quirky habits, like washing tinfoil.

My mother explained to us that Mama Jimmie lived through

the Great Depression. As such, she wasted nothing. I also remember her saying

how lucky we were to not understand the primal urge to preserve everything. But

that is changing fast.

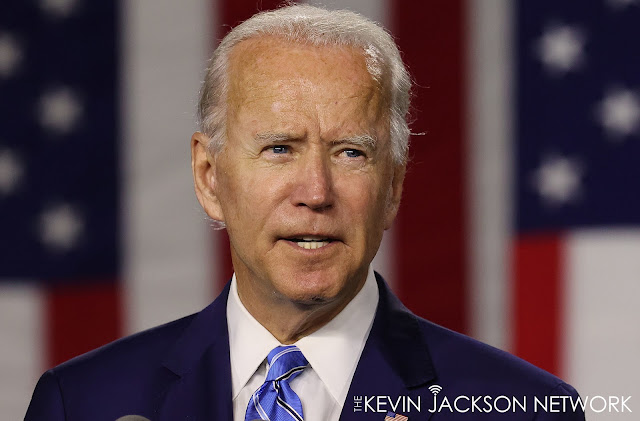

The 2020 election did more than put a demented cheater in

the Oval Office. It unleashed destruction like we’ve never seen. From military

endeavors to energy independence, we’ve become fools on the global stage. The

list of failures is so long, I don’t want to risk carpal tunnel syndrome from

typing it, again. But this inflation, is so bad, it had to be renamed to

reflect the man behind it all– Biden.

The rising prices of food, utilities, and gasoline have

more than wiped out the supposed pay raises the American worker saw over the

past year. It’s like taking one step forward and two steps back. We’re moving

in a negative direction.

When my grandfather died, I found a stack of ration books

from WWII. Families were limited in what they could buy, and let’s get real

here. We aren’t too far from that happening again.

Breitbart adds:

The Labor Department said Tuesday that its consumer price

index jumped 8.5% in March from 12 months earlier — the biggest year-over-year

increase since December 1981. Prices have been driven up by bottlenecked supply

chains, robust consumer demand and disruptions to global food and energy

markets worsened by Russia’s war against Ukraine.

The government’s report also showed that inflation rose

1.2% from February to March, up from a 0.8% increase from January to February.

The March inflation numbers were the first to capture the

full surge in gasoline prices that followed Russia’s invasion of Ukraine on

Feb. 24. Moscow’s brutal attacks have triggered far-reaching Western sanctions

against the Russian economy and have disrupted global food and energy markets.

According to AAA, the average price of a gallon of gasoline — $4.10 — is up 43%

from a year ago, though it has fallen back in the past couple of weeks.

The escalation of energy prices has led to higher

transportation costs for the shipment of goods and components across the

economy, which, in turn, has contributed to higher prices for consumers.

The latest evidence of accelerating prices will solidify

expectations that the Federal Reserve will raise interest rates aggressively in

the coming months to try to slow borrowing and spending and tame inflation. The

financial markets now foresee much steeper rate hikes this year than Fed

officials had signaled as recently as last month.

Even before Russia’s war further spurred price increases,

robust consumer spending, steady pay raises and chronic supply shortages had

sent U.S. consumer inflation to its highest level in four decades. In addition,

housing costs, which make up about a third of the consumer price index, have

escalated, a trend that seems unlikely to reverse anytime soon.

Scamdemic Spending

While Democrats were busy creating toilet paper shortages

and stores were forced to ration goods, Americans tightened their belts.

Economists point out that as the economy has emerged from

the depths of the pandemic, consumers have been gradually broadening their

spending beyond goods to include more services. A result is that high

inflation, which at first had reflected mainly a shortage of goods — from cars

and furniture to electronics and sports equipment — has been emerging in

services, too, like travel, health care and entertainment.

The expected fast pace of the Fed’s rate increases will

make loans sharply more expensive for consumers and businesses. Mortgage rates,

in particular, though not directly influenced by the Fed, have rocketed higher

in recent weeks, making home buying more expensive. Many economists say they

worry that the Fed has waited too long to begin raising rates and might end up

acting so aggressively as to trigger a recession.

For now, the economy as a whole remains solid, with

unemployment near 50-year lows and job openings near record highs. Still,

rocketing inflation, with its impact on Americans’ daily lives, is posing a

political threat to President Joe Biden and his Democratic allies as they seek

to keep control of Congress in November’s midterm elections.

No More #Winning

Sadly, the one thing Joe Biden will be remembered for is

that he cancelled #winning. Wherever Trump put us on top, Biden shot us to the

bottom.

Inflation, which had been largely under control for four

decades, began to accelerate last spring as the U.S. and global economies

rebounded with unexpected speed and strength from the brief but devastating

coronavirus recession that began in the spring of 2020.

The recovery, fueled by huge infusions of government

spending and super-low interest rates, caught businesses by surprise, forcing

them to scramble to meet surging customer demand. Factories, ports and freight

yards struggled to keep up, leading to chronic shipping delays and price

spikes.

Critics also blame, in part, the Biden administration’s

$1.9 trillion March 2021 stimulus program, which included $1,400 relief checks

for most households, for helping overheat an already sizzling economy.

Many Americans have been receiving pay increases, but the

pace of inflation has more than wiped out those gains for most people. In

February, after accounting for inflation, average hourly wages fell 2.5% from a

year earlier. It was the 11th straight monthly drop in inflation-adjusted

wages.

Unfortunately, it’s the hardest working

families that are hit the hardest.

It doesn’t matter how many excuses Biden

makes. Because excuses don’t pay the bills or feed the kids.

Once you make just enough to get off the poverty level,

you no longer qualify for food stamps, but you can’t afford food. You can’t get

rental assistance, but you can’t pay the rent. To be fair, these are the kinds

of families that don’t want public assistance, but the fact that middle class

families can’t make it is a tragedy that continues to spread deeper and wider.

Still, Democrats refuse to thrown in the towel. They just

continue to ride this freight train to hell and they don’t care how many of us

will go down, just as long as we got rid of the orange man.

https://theblacksphere.net/2022/04/bidenflation-roars-on-setting-new-record-highs/